Each year, insurance claims for uninsured vehicles cost €60-€70m million.

The system will significantly increase the number of detections and reduce the incentive for people to drive without insurance.

According to The Motor Insurance Bureau of Ireland (MIBI), there are about 184,000 uninsured vehicles on the road. This represents about 8.4% or 1 in 12 vehicles, which is very high relative to other countries. The detection of vehicles without motor insurance is a very important task for the Gardai and the Roads Policing unit, in particular. The Insurance industry, in cooperation with Insurance Ireland, the MIBI, An Garda Síochána and the Department of Transport, has implemented a central insurance database which is referred to as the Irish Motor Insurance Database (IMID), which will help identify uninsured drivers. This database is underpinned by Legislation under Section 78A of the Road Traffic and Roads Act (2023), which requires all insurers to provide motor policy information to the database.

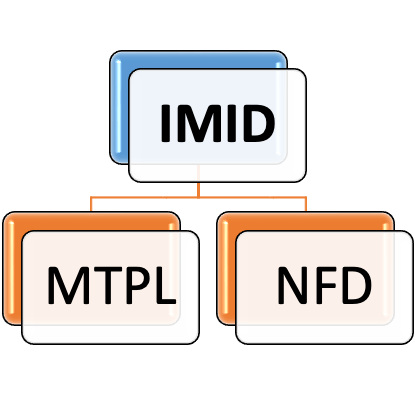

The IMID is made up of two separate databases, including the Motor Third Party Liability (MTPL) Database and the National Fleet Database (NFD). The MTPL database contains policy, vehicle and driver details for private motor and small commercial vehicles, while the NFD contains policy, vehicle and driver details for fleet vehicles and motor trade vehicles.

“In Ireland, it’s compulsory for all vehicles to have motor insurance. If any person suffers physical injury and property damage that’s caused by an uninsured vehicle, MIBI will deal with the claim and pay compensation to the victim. MIBI, as a not-for-profit organisation, is financed by levies on the insurance industry which. These levies are ultimately paid by law-abiding insured motorists with €30-€35 included in the premium paid by drivers,” explains Tom O’Brien, Technical Claims Manager at MIBI.

“This puts an extra burden on law-abiding drivers and motor insurance companies while the person with an uninsured vehicle attempts to get away without paying anything. However, the MIBI has strong powers of recovery and will pursue uninsured drivers through the Courts to seek recovery of money that’s paid out in compensation to claimants. The introduction of IMID will be a game changer for the Gardai as they will now be able to immediately check the insurance status of both vehicles and drivers when they interdict a vehicle on the road.”

TEKenable was selected as the preferred solution provider because of the company’s experience and expertise in the marketplace. As a Microsoft Gold Partner, TEKenable could deliver the complex project and develop software to extend the functionality of the solution.

Working closely with the insurance industry, through Insurance Ireland and the MIBI, TEKenable identified the need to provide an efficient and cost-effective solution for insurers and the Gardai to meet the obligations placed on them by the legislation. TEKenable designed and developed the Motor Third Party Liability (MTPL) Database and the National Fleet Database (NFD) which will assist the Gardai in enforcement of insurance requirements in the Road Traffic Act. This will ultimately help to reduce uninsured driving which in turn will reduce premiums and improve road safety. TEKenable implemented the system on Microsoft Azure Cloud as it was perfect for this project from the perspective of security, scalability and rapid solution building. It uses a server-less computing model in Azure with micro-segmentation of services along with SOC/SIEM for security and a PaaS database service handling a number of large-scale data repositories.

The IMID integrates with the underwriting platforms of approximately 40 insurers. When completed, MIBI will provide data to Garda systems, including the Garda roadside mobile application and the National Vehicle & Driver File (NVDF) at the Department of Transport. The IMID is one of the largest financial services databases in Ireland today, as it contains details on over 3m vehicles and over 5 million drivers that are insured to drive those vehicles.

The complex and sensitive database will allow Gardai, the Department of Transport and the MIBI to see real-time insurance data pertaining to motor vehicle policies and the drivers covered by those policies. The IMID will replace an earlier central insurance database (ANPR) that was also developed by TEKenable but is now retired.

“The new system delivers a safeguarded, distributed database that connects insurers, MIBI, the Department of Transport and the Gardai, giving them highly secure access to motor insurance data at any time.

When the data in IMID is shared with the Gardai, it will facilitate live access to insurance data by Gardai at the road side through their mobile devices. This will allow them to check the insurance status of both vehicles and drivers that they have been stopped.

This will help reduce uninsured driving and improve road safety,” concludes Tom O’Brien.

TEKenable built the system, which gives all parties more real-time visibility to the information that is required by all stakeholders. It’s a robust, secure and compliant cloud system. As a technology provider, TEKenable is our partner of choice on this project as the company offers a proactive and innovative service. The team are experts in Microsoft and emerging technologies, and they are always willing to go the extra mile.”

“IMID is a very complex and highly secure system that allows access to public-facing elements as well as closed interfaces that are only accessible to insurers, MIBI, An Garda Siochana, and the Department of Transport. It is a multi-year, multi-million euro insurance industry project that TEKenable played a lead role in designing, developing and ultimately hosting on behalf of the industry,” Tom O’Brien (Technical Claims Manager, MIBI).